Enabling conversational AI for banking that understands your customers first time, every time

A new era of conversational interfaces for banking

action.ai’s natural language technology powers conversational interfaces that enable business banking customers to engage with their accounts with greater speed, ease and accessibility. Whether using voice or text, customers can access a range of banking products and services instantly and 24/7 – without needing to revert to customer service staff.

We have built a platform that enables banks to be self sufficient, providing the dialogue management source code, so they’re in charge, and able to connect to their own in-house APIs.

We enable your virtual agents to get smarter over time and deliver delightful customer service.

Time pressed business owners and managers can manage their finances ‘in the moment’ by using voice or text virtual assistants to request financial accounting information.

Want some up to-to-date information from your accountancy software? Just ask for it. Want to check a banking transactions quickly and easily? Just ask.

The ‘virtual assistant’ technology frees business owners and managers from time-consuming activities such as scanning through complex reports or navigating multiple screens, menus and documents to search for data. Through automation we can significantly reduce customer calls and the volume of live chat.

Conversational business banking ROI.

The numbers speak for themselves

Based on 84,000 calls per month

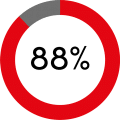

Automate 88% of conversations

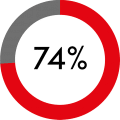

74% reduction in

total costs

Save £730k

per month

Natural language is the heart of a delightful customer experience

We provide banks with advanced natural language processing technology to create sophisticated, self-sufficient, conversational interfaces for their customers.

These take the shape of virtual assistants that fully automate the customer’s interaction with their bank, regardless of how complex their needs are, and whether using voice or text. We support call deflection, while customers can enjoy a responsive and enjoyable automated service that feels extraordinarily human.

Fully scalable technology

Our technology can be deployed at scale. Not only does it streamline banking-related customer services, it significantly uplifts the NPS from day one and nurtures customer loyalty. It also actively improves the customer experience by eradicating waiting times and is available all day, every day.

Whether customers are communicating with voice or text, our natural-language technology ensures they are understood first time, and every time.

Adding the ‘delight factor’ to conversational banking

Find out how improving the customer experience in banking gives back more than just satisfied customers.

In this short video, John Taylor CEO of action.ai talks about how automation can exceed customers’ expectations whilst also driving huge operational efficiencies

Adding the ‘delight factor’ to

conversational banking

Find out how improving the customer experience in banking gives back more than just satisfied customers.

In this short video, John Taylor CEO of action.ai talks about how automation can exceed customers’ expectations whilst also driving huge operational efficiencies

action.ai’s technology is really slick … both jaw-dropping in how smooth and natural it made the conversation, and at the same time, astonishing that we somehow accept less than this today.

Head of Technology

Nadella’s Radical Vision: How Agentic AI is changing SaaS forever